When managing your payment operations you need a clear, immediate understanding of your customers' statuses and your funding sources. That's why we’re excited to announce a significant enhancement to the Customers List page in your Dwolla Dashboard, along with a helpful update to your Account Funding Sources.

Revamped Customer List for At-a-Glance Insights

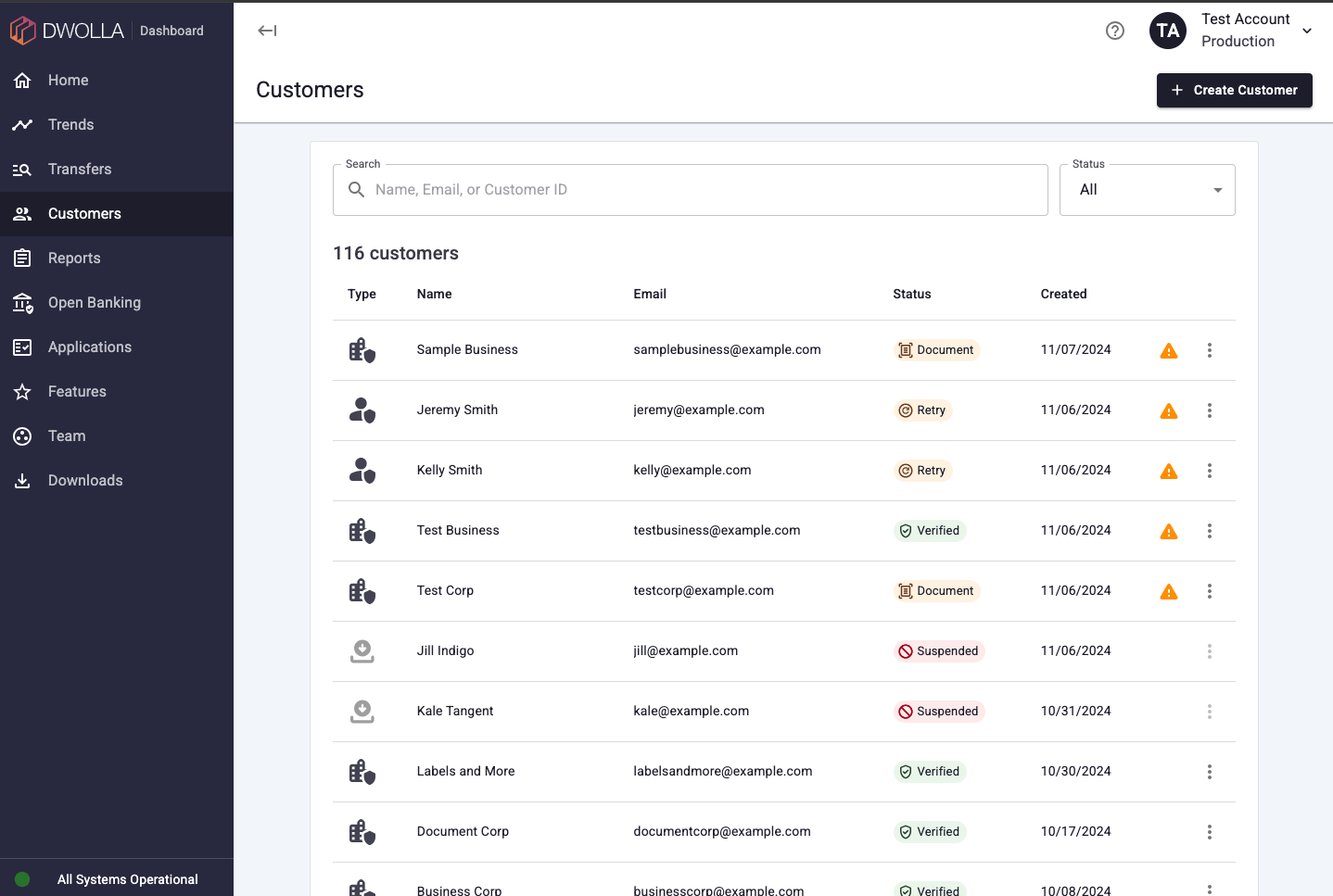

We’ve completely overhauled the Customer List page to provide a more intuitive and visual experience. The update introduces a new Type column with icons, making it easier than ever to distinguish between your different customer types at a glance. This works alongside the existing Status column to give you a complete picture of each customer.

You'll now see clear, distinct icons for:

Personal Verified Customers

Personal Verified Customers Business Verified Customers

Business Verified Customers Receive-Only Customers

Receive-Only Customers Unverified Customers

Unverified Customers

To eliminate any guesswork, we've also added tooltips to each icon in the Type column. Simply hover over an icon to see the full-text name (for example, "Receive-Only Customer"). Additionally, a new warning icon will provide more clarity for "Verified" customers who still have pending actions, such as beneficial ownership verification, that prevent them from accessing full account capabilities.

Enhancements to Account Funding Sources

We've also rolled out a frequently requested update to the Account Funding Source page.

- Account and Routing Numbers: You can now see the last four digits of the account and routing numbers for your own funding sources, giving you the same level of detail you have about your customers’ funding sources.

- Refreshed Design: While we were at it, we migrated the page to our new design system to create a consistent, modern look and feel.

How this helps you:

- Find Information Faster: The new Type icons and distinct status chips on the Customer List page allow you to instantly identify a customer's state without clicking into their details page.

- Eliminate Confusion: Clear tooltips and new warning icons on the Customer List page provide immediate context and surface critical, actionable information.

- Improve Operational Efficiency: By adding account and routing numbers to your funding sources, we're saving you time and making it easier to identify your accounts.

These updates are live in your Dashboard now. Sign in to the Dwolla Dashboard and navigate to the Customers page or your Account Funding Source details to try them out.

If you have any questions or need assistance, please email support@dwolla.com.