Secure Payments with Open Banking

The Benefits of Open Banking

Open banking is revolutionizing the way businesses process payments by giving individuals or businesses greater control and ownership over their financial information. It promotes the secure access and exchange of financial information between various financial institutions and authorized third-party providers through application programming interfaces (APIs). Open banking helps businesses streamline their payment processes, improve the customer experience and enhance security

By simplifying the payment process and offering a more convenient and user-friendly experience, open banking helps businesses increase customer satisfaction and drive conversions.

Open banking utilizes strong authentication methods, including tokenization, which replaces sensitive data with unique, non-sensitive tokens.

“There hasn’t been any downtime or issues that prevented either the distribution or contribution side of our payment infrastructure. If the goal is to build a really great user experience, Dwolla is the best solution we’ve found.”

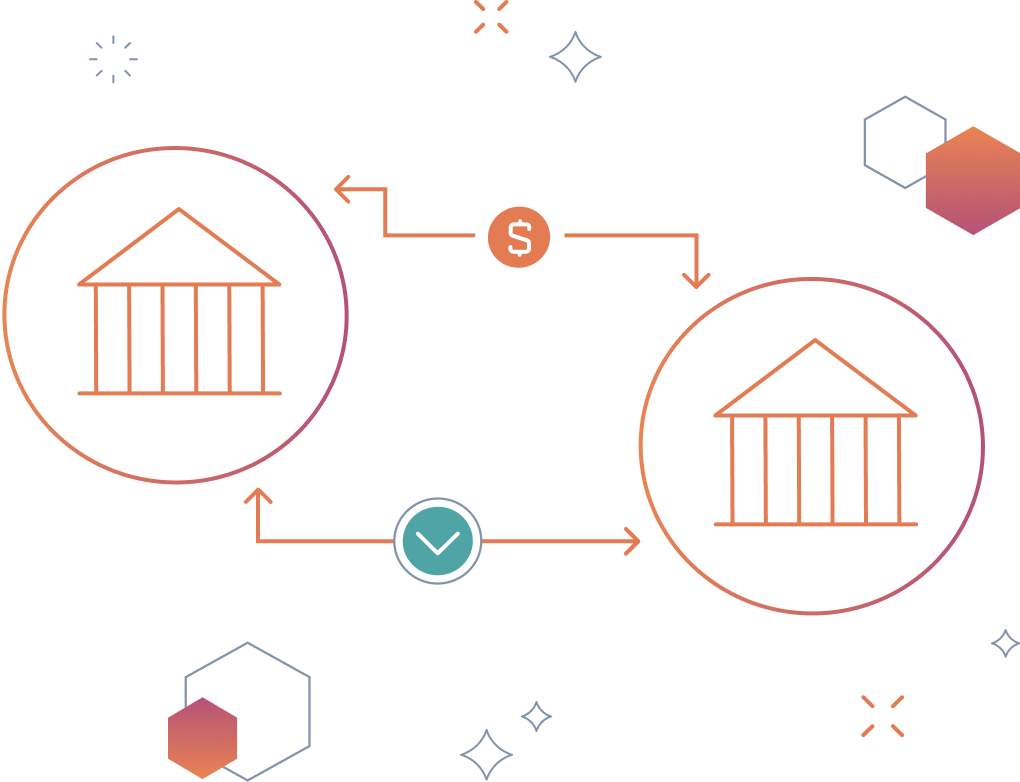

How Open Banking Works

You can utilize open banking with Dwolla’s pay by bank payment methods in two different ways.

Dwolla's Open Banking Services

Dwolla’s Open Banking Services allows businesses to get open banking features and pay by bank payments through a single API and single vendor - Dwolla. Dwolla collaborates with Plaid and MX for its Open Banking Services.

Benefits:

- Tailors open banking features and functionality for payments use cases

- Helps provide a smoother implementation process for businesses

- Reduces complexity and accelerates time-to-market for pay by bank solutions

Available open banking features include:

- Instant Account Verification (IAV): Instantly (within seconds) confirm the bank account is open and active, and let customers continue through the authentication and payment flows immediately. This decreases abandonment rates for the account linking process and creates a smoother, more streamlined customer experience.

- Real-Time Balance Check: Check the real-time current and available balances in a bank account before pulling money from it to cover a transaction. This helps reduce the risk of returns due to insufficient funds. Note: Businesses must use IAV through Dwolla's Open Banking Services to verify a bank account before using real-time balance check for that account.

Secure Exchange Solution

Through Dwolla’s Secure Exchange Solution, businesses can easily integrate with Dwolla's data partners and securely exchange information between their APIs and the Dwolla API. Create an exchange, pass it to the endpoint and access the desired functionality. Dwolla partners with Plaid, MX, Finicity and Flinks for its Secure Exchange Solution.

Benefits

- Reduces the amount of sensitive customer information stored on your platform

- Increases flexibility by offering access to a lot of functionality through a single token

- Unlocks the power of open banking with minimal engineering resources

Collaborating with Industry Leaders

Integrate pay by bank payments in as little as ten days.

Dwolla's full-service approach replaces legacy payments technology with a single solution, improving security, data visibility and the customer experience.