Revolutionizing Real Estate Payments

Elevate your vendor and supplier relationships by replacing legacy technology and outdated payment systems with Dwolla's faster, more secure alternatives.

BEFORE DIGITAL TRANSFORMATION

Industry Payment Challenges

The real estate industry grapples with inefficient payment processes that impact business relationships and bottom lines.

Legacy Technology Hurdles

- Outdated payment systems and manual processes slow down transactions

- Increased likelihood of human error

- Significant time and money wasted on inefficient processes

Risking Vendor and Supplier Relationships

- Legacy infrastructure hinders the ability to maintain and grow key business relationships

- Slow, unreliable payments create friction with partners

- Delayed payments can impact supply chains and transaction processing speeds

Payment Security Concerns

- Large property values, quick turnaround times, and multiple stakeholders must be considered

- Risks of costly fraud incidents and security breaches

- Potential for reputational damage and erosion of trust between involved parties

AFTER DIGITAL TRANSFORMATION

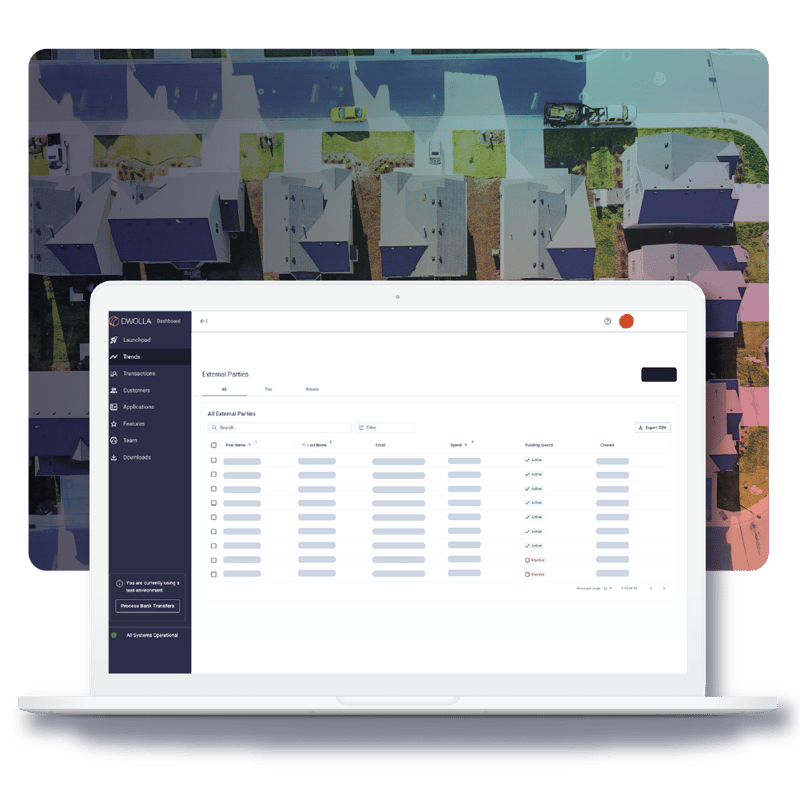

Dwolla: Your Modern Payments Partner

Transform your real estate payment operations with Dwolla's enhanced payment services.

Accelerated Payments, Reduced Costs

- Replace checks and legacy systems with streamlined A2A payments, including instant options

- Access all banks and A2A payment methods through a well-documented, single API

- Automate and digitize payments for improved cash flow and predictability

- Gain real-time visibility into payment data for easier tracking and reporting

Enhanced Vendor and Supplier Relationships

- Build loyalty through faster, smoother, and more predictable payments

- Leverage A2A payment methods and automation to speed up processes

- Reduce manual intervention and human error

- Streamline the replacement of legacy technology with Dwolla's best-in-class developer resources and consultative approach

Fortified Payment Security

- Leverage tokenization to protect sensitive data during transmission

- Minimize the risk of unauthorized data interception

- Reduce human error through automated processes, limiting exposure of sensitive information

Success Story: Real Estate Platform Fights Fraud with ACH

Leveraging ACH payments through Dwolla, this innovative platform successfully facilitates over 120,000 earnest money deposits for homeowners and agents—with zero fraud.

Ready to Transform Your Real Estate Payment Operations?

Don't let outdated systems hold your real estate business back. Embrace the future of payment technology with Dwolla.- Accelerate payment processing and reduce costs

- Strengthen vendor and supplier relationships

- Enhance payment security measures