Tracking Transactions & Reconciling Bank Records

The Benefits of Correlation IDs

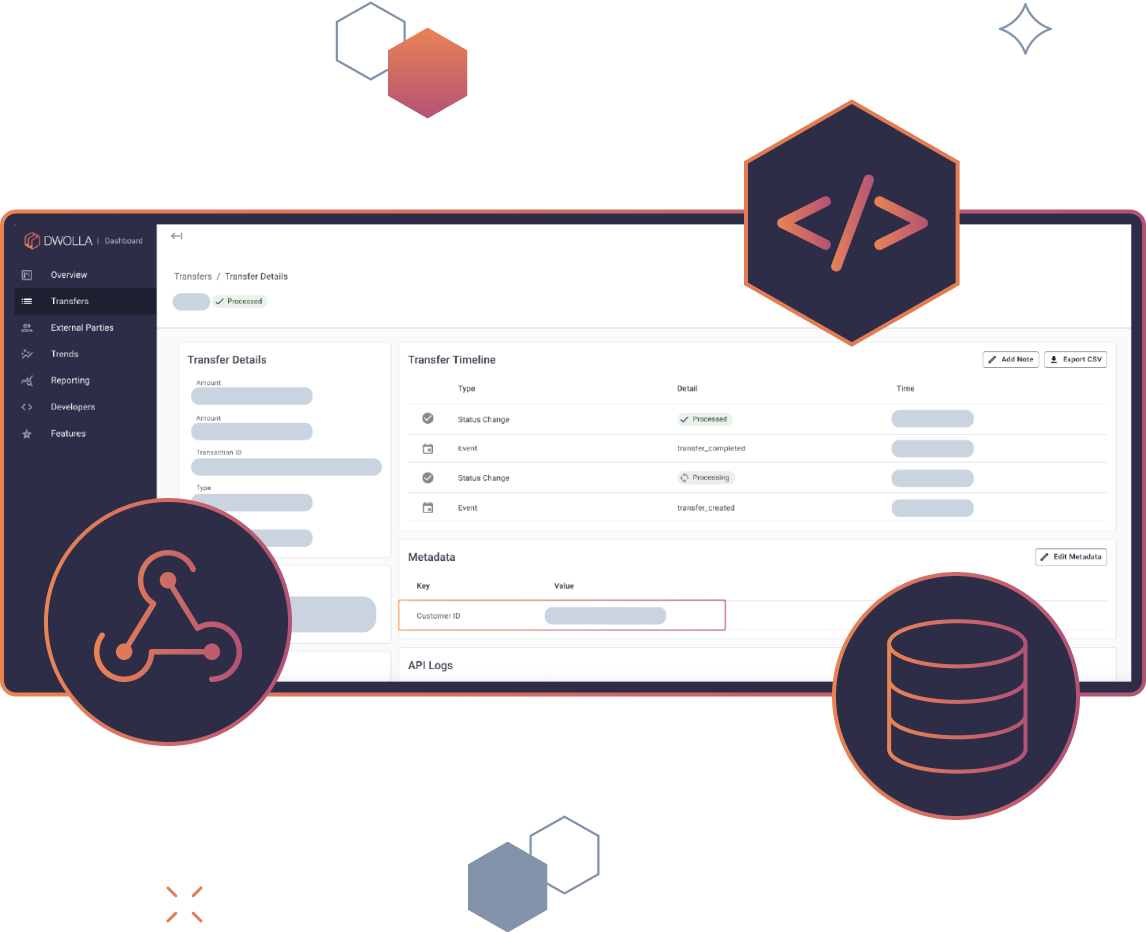

In order to truly reap the benefits of automating payments, you need a single identifier to help you track payments from end-to-end across systems and help you close out payables and receivables in your systems. This is where correlation IDs come into play. Instead of having to build a process that matches payments in your system to Dwolla or bank payment IDs, you can build in an identifier (a correlation ID) to do that matching for you automatically.

The Correlation ID value can be specified on API requests to create a Dwolla Transfer or External Party resource. Whether you use this optional parameter to correlate internal transfers, order confirmation numbers, business IDs or even a timestamp, its simplicity provides a lot of power.

Automate your payments in as little as ten days.

Dwolla's full-service approach replaces legacy payments technology with a single solution, improving security, data visibility and the customer experience.