Securely Exchange Data

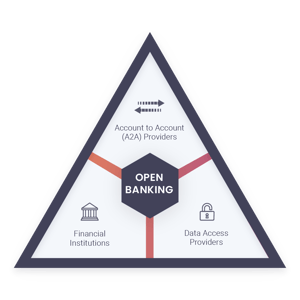

Access to Open Banking

The Secure Exchange Solution prioritizes flexibility that allows us to bring on new data providers quickly and easily.

The reduction in complexity and time investment on our end allows us to remain nimble and make continuous improvements to the solution. As we grow and expand our offerings, that same flexibility will be offered to our clients, who will be able to configure a solution to meet their needs, all under the umbrella of one Dwolla integration.

Create an exchange, pass it to the endpoint and access the desired functionality. With minimal engineering resources, you’ll be able to unlock the power of Open Banking and delight your users with a secure, tokenized experience.

Automate your payments in as little as ten days.

Dwolla's full-service approach replaces legacy payments technology with a single solution, improving security, data visibility and the customer experience.