Dwolla Connect (Beta) Launch

Dwolla recently introduced Dwolla Connect, its new modern API solution that simplifies payment management across banking providers for companies looking to scale. With Dwolla Connect, businesses can simplify the process of replacing legacy, batch-based technology with modern infrastructure and digitally transform their payment operations.

Key Features:

- Digitally transform your payment operations with a modern, developer friendly API experience.

- Reduce integration timelines and enhance the management of payments across multiple financial institutions with a single API.

- Consolidate your payments across providers in a single view.

- Use your existing commercial account with your banking partners of choice.

- Test your integration using a fully simulated testing environment.

Availability:

- U.S. payments

- Standard ACH, Same Day ACH, Wires

- Wells Fargo and J.P. Morgan

Coming Soon:

- Developer documentation

- Additional banking network coverage

- New payment methods

- Value added services

Learn more about Dwolla Connect by visiting our Connect web page and reading our Connect blog post.

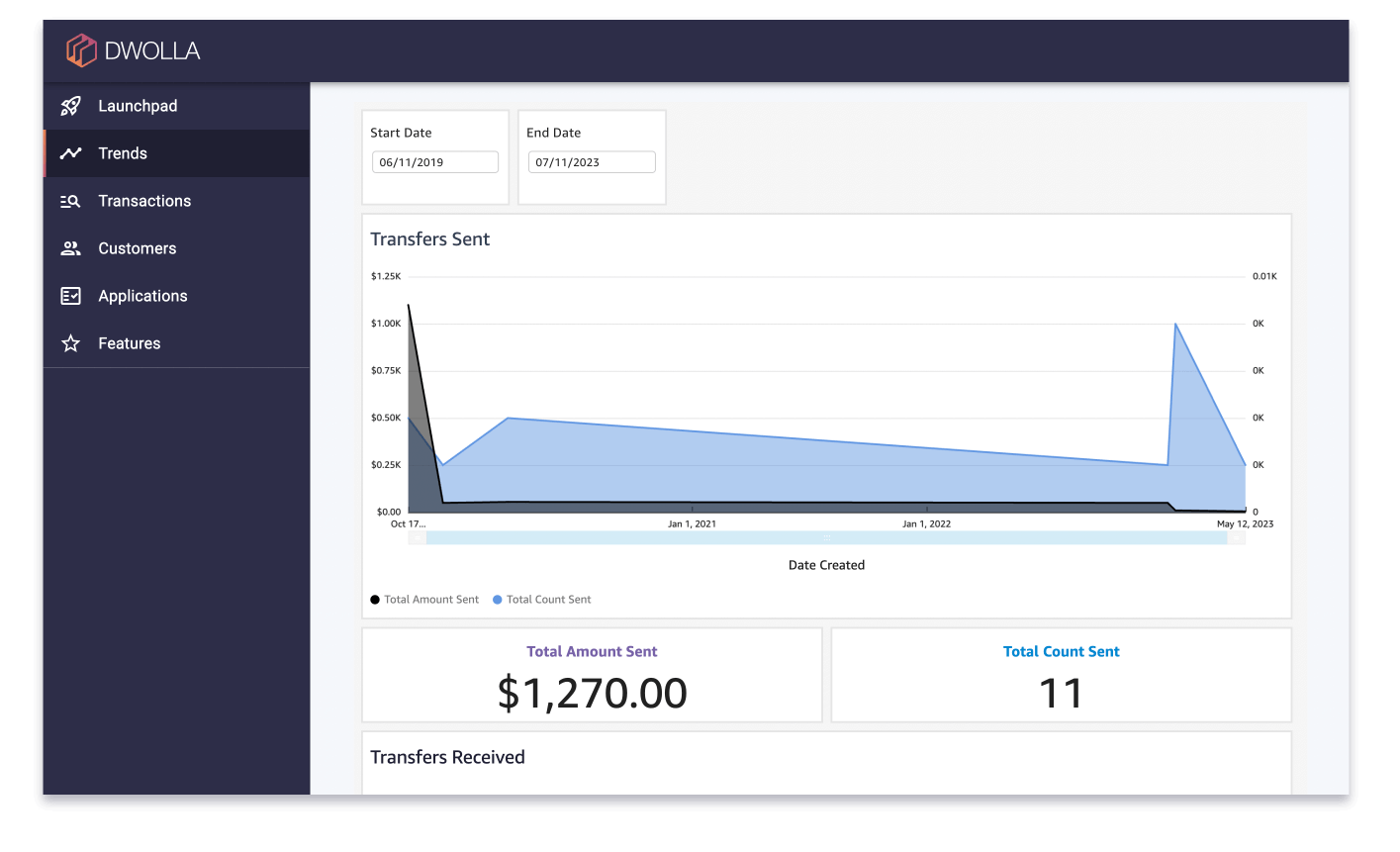

Enhanced Reporting in the Dashboard

To continue to help businesses manage their payment experience and better understand their payments data, we’ve recently rolled out updates to significantly improve the speed and responsiveness of the reports available in the Dwolla Dashboard.

In addition to performance improvements, we added some new capabilities to the Trends page, available now in both sandbox and production environments.

- Choose from a wider selection of date ranges.

- Maximize and minimize each graph or insight.

- View the summary and export the data in the visuals.

We are never done, so if you’re interested in sharing your feedback or experience with us, please reach out to product@dwolla.com.

New Unified Dashboard

With the introduction of Dwolla Connect, Dwolla is working to create a new single dashboard experience for both the Dwolla Balance and Dwolla Connect. It will include the following:

- Single Sign-On: No need to remember multiple sets of Dwolla credentials. Clients will have a single username and password for the Dashboard, Sandbox and the Dwolla Support Portal.

- Environment Access: Easily navigate from your Sandbox environment to your production environment, and between multiple accounts in each environment. The new Dashboard will bridge the environments, simplifying your payments integration.

- New Features: The new Dashboard will have a refreshed experience for viewing/managing transactions across your integration. This more transparent experience will make it easier to track your transactions as they navigate the payments networks.

Many more changes to come! If you’re interested in providing dashboard feedback, please reach out to our product team at product@dwolla.com, and we’ll be in touch shortly.

Dwolla.js Sunset: Transition from dwolla.js to dwolla-web.js

On August 31, 2023, we will sunset our legacy client-side JavaScript library, dwolla.js, which includes functions for creating a funding source for a Customer. We’re replacing this legacy library with functionality that has been added to our Drop-in Components library, dwolla-web.js. It will serve as the primary web UI components library and offer an enhanced developer experience. Learn more from the announcement post and migration guide on our community forum.

Data Aggregator Added to Secure Exchange Solution

Dwolla has incorporated Flinks, an integrated data aggregator, into its Secure Exchange solution. This strategic integration expands Dwolla's offering of quick account verification options, through which clients can enable end users to promptly initiate transactions.

1099-K Automation

To ensure timely compliance with IRS deadlines, we have automated the scheduling of all key internal technical processes for the Form 1099-K process, including our process for requesting Form W-9 information. We’re now requesting any needed Form W-9 information on a weekly basis from clients and end users that have reached the $600 threshold for the 2023 calendar year. Sending the requests weekly rather than all at once at the end of the year will streamline the process of issuing Form 1099-K to clients and end users.

Instant Account Verification

Integrating with a new payments solution can be a lot of work. At Dwolla, we strive to streamline our onboarding and approval processes so you can start serving your customers more quickly. In our latest onboarding enhancement, we added Plaid Link to ease the process of adding and updating a funding account.

Email Setting Updates

Reseller partners use Dwolla’s Account Opening API to embed account-to-account payments into their offering. We recently updated the Account Opening API so reseller partners can collect information about and set up custom email settings for their clients earlier in each client’s onboarding process. In the end, this gives reseller partner clients more control over the look and feel of the emails the users of their platforms receive.

FedNow and RTP Update

FedNow is a new instant payments system from the Federal Reserve that will allow individuals and businesses to send and receive payments within seconds at any time of day, on any day of the year. We are excited about the potential of FedNow to revolutionize the way we send and receive payments, but we have decided to wait to support FedNow until adoption and usage increases.

According to the Federal Reserve, only a small percentage of financial institutions have adopted FedNow, and even fewer are using it. Of the 51 organizations participating in FedNow at launch, most are only certified to receive, not send, payments.

In addition, most of the payments eligible for FedNow could instead be sent using the RTP® Network. More than 30% of the early adopters are already full participants of the RTP network, which is used by over 700 financial institutions and processed over $2 trillion in payments in 2022.

We will continue to monitor the development and adoption of FedNow and provide updates around when we plan to support it. In the meantime, we encourage clients to use the RTP network for instant payments as the FedNow Service continues to ramp up.

Enhanced Support Options

To support the continued business growth and scalability of our valued clients and partners, we are excited to introduce two support tiers:

- Basic Support: Gain access to the Dwolla Support Portal, email support, a comprehensive collection of support articles, our developer forum and robust developer documentation.

- Premium Support: Enjoy all the features provided in Basic Support, plus the added benefits of live chat support, access to beta products, and enhanced and customizable solutions.

These support options have been designed to ensure that our clients and partners receive the necessary assistance and guidance they need for their ongoing success.