Dwolla's Open Banking Services

Dwolla has launched its groundbreaking Open Banking Services. Dwolla simplifies the A2A payment experience through its Open Banking Services by pre-integrating with leading open banking service providers. This pre-integration ensures a smoother implementation process for businesses and can reduce complexity and accelerate time-to-market for A2A payment solutions – all through Dwolla’s single API.

MX Integration

Dwolla has announced that MX is one of its Open Banking Services partners. Dwolla’s Open Banking Services take advantage of MX’s Instant Account Verifications (IAV) and account aggregation solutions to provide mid- to enterprise-sized businesses with bank verification capabilities. Check out the developer documentation for Dwolla Balance and Dwolla Connect.

DASHBOARD

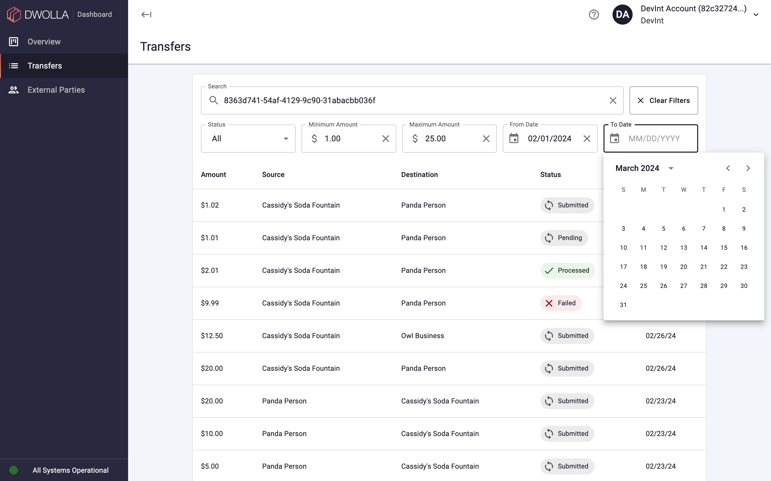

Search and Filter Transfers in the Dashboard (Connect)

We've improved the transfer search functionality in the Dashboard to help you quickly find specific transactions. You can now filter and search transfers based on three key criteria:

- Status: Narrow down your search by selecting the transfer status (e.g., Submitted, Pending, Processed, Failed).

- Amount Range: Focus on transfers within a specific range by defining a minimum and maximum amount.

- Date Range: Search for transfers that occurred within a defined timeframe.

This new functionality provides the following benefits:

- Faster Insights: Locate relevant transfers effortlessly, saving you valuable time in managing your finances.

- Greater Control: Refine your search based on specific criteria to gain a more focused view of your transfer activity.

- Improved Visibility: Track specific transfers by status, amount and date.

Other Dashboard Improvements

Connect

- Added Correlation ID and Addenda records to the Transfer Details page

- Added External Party Funding Source details, such as Funding Source ID and Bank Account Type

Balance

- Added failure reasons for Virtual Account Numbers (VANs) and real-time payments (RTP) to transaction export

BALANCE

Streamlined Business End User Verification Process

Previously, business end users were sometimes required to provide the same pieces of information multiple times during user verification. We’ve adjusted our business end user verification process to at least reduce if not eliminate these redundant steps.

Beta Features

In our last release notes, we described two new beta features for the Dwolla Balance product: Custom Company Entry Descriptions and Refund Transactions. These features are now more widely available. If you’re interested in learning more about either of these beta features, please reach out to product@dwolla.com.